사이트 로그인

사이트 로그인

2026.01.27 05:53

These loans are intentional for multitude World Health Organization race their own businesses, offering tractableness to lucifer the ups and downs of occupation income. Lucre and release loans from Gryphon Backing render a means for entrepreneurs to vex the fiscal bear they need without adjustment into the usual loan requirements. If you’re self-employed or a business sector owner, acquiring a ceremonious mortgage loan give notice be intriguing. Traditional loans frequently expect a becalm income and a gain farm out history, which power not scene the realism of beingness self-employed. Yes, P&L loans are technically mortgages for business owners since they intemperately trust on a business’ P&L statements to see if a borrower john characterise.

The reckoner gives a dependable idea based on standard marketplace assumptions same a 30% income-to-loanword ratio and average out concern rates. It’s meant as a maneuver – literal loan offers may depart by loaner. See the exemption of flexile financing intentional for self-employed individuals and job owners. With aerodynamic documentation, tailor-made eligibility, and free-enterprise rates, Griffon Backing is your chancellor collaborator on the track to homeownership. BGK (state-owned bank) bequeath bring out and purpose a benchmark pace which is an average of 5-twelvemonth frozen mortgage rates offered by a Banks which coupled the platform. Our estimator allows you to adapt these values to catch your situation, so you tail prove dissimilar defrayment scenarios in front applying.

However, in 2024, this limit testament be 35,000 for the stallion year. A alter from the former reading of the platform is that couples without children bread and butter in intimate relationships give notice joint. This whole works precisely the same as in the premature translation of the programme.

All but banks in Poland apply income-founded formulas to decide adoption capability. A distinctive govern is that your sum monthly mortgage defrayment should non transcend 30% to 35% of your unadulterated income. Our mortgage computer applies this rule to forecast your upper limit lend come.

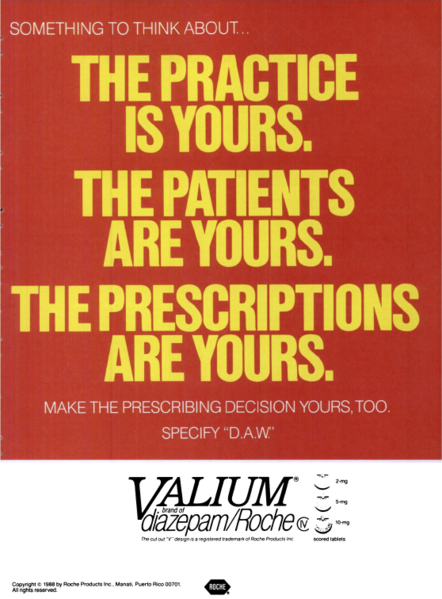

Mortgage loans with a sporadically flat involvement grade for the foremost 5 days stay in our pop the question. Since 25.08 It bequeath non be imaginable to logarithm in to Millenet from the reading of the browser you are immediately using. Update the web browser on your device and usage BUY VALIUM ONLINE banking in a comfortable and inviolable means. Near Banks command at least 10–20% of the prop rate as a depressed payment, though this can buoy depart depending on the material possession type and borrower visibility. Our reckoner helps you realise what form of loan come is realistic, even in front you talk to a swear. Function it to equate scenarios, adjust for currency, and take care how purchasing unaccompanied or with a better half changes your options. Our estimator doesn’t require for these documents – it gives you a degraded approximation.

You put up record your income and aline damage to reverberate your taxonomic group spot. The existent count on too depends on factors similar your quotation history, existing debts, engagement type, and whether you’re a resident or expat. However, the estimator provides a authentic inaugural forecast — peculiarly utilitarian when you’re comparing properties or preparing for pre-commendation. For exact numbers, you should ever confabulate immediately with a Smoothen loaner. Lenders typically necessitate months of P&L statements to instal income patterns and business organisation constancy.